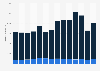

Size of the U.S. automotive parts aftermarket 2013/2025

This timeline shows the size of the U.S. automotive parts aftermarket from 2013 through 2025, by segment. The do-it-yourself (DIY) automotive aftermarket parts segment in the United States was sized at around 20 billion U.S. dollars in 2013.

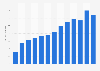

U.S. automotive parts aftermarket

Following a period of economic instability, the automotive aftermarket parts industry in the United States is expected to benefit from increasing U.S. vehicle sales and thus continue to rebound. In 2016, customers in the United States bought around 17.46 million vehicles; a figure that was about seven million higher than during the 2009 financial crisis. The upward trend is further fuelled by the rising number of car owners who have been holding on to their automobiles for longer periods: The average age of a light vehicle in the United States stood at around 11.6 years in 2016, up from about 8.4 in 1995. In light of an aging vehicle fleet and a growing number of vehicles that require servicing, the growth in demand is projected to push the automotive aftermarket parts industry’s revenue up to roughly 70 billion U.S. dollars in the do-it-for-me (DIFM) segment in 2025.

The automotive aftermarket industry, which accounts for an estimated third of the U.S. automotive parts industry, can be divided into two main categories: accessories and replacement parts. While accessories are typically designed for add-on after the original assembly of a vehicle, replacement parts are built or remanufactured to replace original equipment parts that have become damaged or worn. The industry is highly fragmented and comprises a great variety of products, including exterior and structural products, appearance chemicals, mechanical products, electrical products and electronic products.

U.S. automotive parts aftermarket

Following a period of economic instability, the automotive aftermarket parts industry in the United States is expected to benefit from increasing U.S. vehicle sales and thus continue to rebound. In 2016, customers in the United States bought around 17.46 million vehicles; a figure that was about seven million higher than during the 2009 financial crisis. The upward trend is further fuelled by the rising number of car owners who have been holding on to their automobiles for longer periods: The average age of a light vehicle in the United States stood at around 11.6 years in 2016, up from about 8.4 in 1995. In light of an aging vehicle fleet and a growing number of vehicles that require servicing, the growth in demand is projected to push the automotive aftermarket parts industry’s revenue up to roughly 70 billion U.S. dollars in the do-it-for-me (DIFM) segment in 2025.

The automotive aftermarket industry, which accounts for an estimated third of the U.S. automotive parts industry, can be divided into two main categories: accessories and replacement parts. While accessories are typically designed for add-on after the original assembly of a vehicle, replacement parts are built or remanufactured to replace original equipment parts that have become damaged or worn. The industry is highly fragmented and comprises a great variety of products, including exterior and structural products, appearance chemicals, mechanical products, electrical products and electronic products.