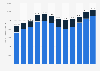

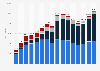

In terms of the international car trade, the growth rate of car imports to China had reached its peak in 2010 at 93 percent after the global financial crisis of the previous year. Figures showed a continuous slowdown until contracting by 6.2 percent in 2022. Not only does China have the world’s biggest new car market, but it also has a growing used car market with the trade value of used cars reaching nearly 1.1 billion yuan as of 2022.

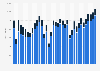

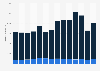

In the following months, however, sales began to increase but dropped again in January 2023. At the end of that month, China abandoned its Zero COVID Policy and monthly sales have began to grow again.

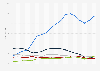

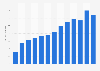

EV sales have not been spared by the tough lockdown measures in China. Reflecting the drop in internal combustion engine (ICE) vehicle sales, sales of passenger and commercial EVs suffered during China's lockdowns of 2021 and 2022 as well. However, the year 2023 has seen a stable growth of EV sales in the country, reaching 846,000 units sold in August 2023, the highest sales volume in the last three years.

Slow recovery after COVID-19 lockdowns

Following China's draconian lockdowns to battle coronavirus outbreaks, the country’s automobile industry has been hit by the measures. In April 2022, sales of passenger cars plunged by 48 percent from the previous month and by 43.4 percent year-over-year to about 965,000 units. During the same period, commercial vehicle sales dropped by 42 percent compared to the previous month and by 60.5 percent year-over-year to approximately 216,000 units. Such a large drop resulted in the lowest monthly auto sales ever recorded, as production fell and consumers were kept out of stores.In the following months, however, sales began to increase but dropped again in January 2023. At the end of that month, China abandoned its Zero COVID Policy and monthly sales have began to grow again.

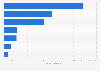

The booming electric vehicle market

China is known as the largest electric vehicle (EV) market in the world, with EV sales surging to 3.5 million in 2021 and its market share soaring to 13.3 percent. Battery electric vehicles dominated the mainstream markets, with about 10.9 percent market share for the year. The popularity of BEVs compared to gasoline vehicles is due to the fact that they not only do not spew CO2 while driving but also produce less noise and save energy at the same time. Among passenger EV companies in China, BYD Auto, the SAIC-GM-Wuling joint venture, and Tesla led in sales in 2021 and 2022.EV sales have not been spared by the tough lockdown measures in China. Reflecting the drop in internal combustion engine (ICE) vehicle sales, sales of passenger and commercial EVs suffered during China's lockdowns of 2021 and 2022 as well. However, the year 2023 has seen a stable growth of EV sales in the country, reaching 846,000 units sold in August 2023, the highest sales volume in the last three years.